Company: Daqo New Energy Corp. (NYSE: DQ)

Sector: Renewable Energy

Price (Aug.16th, 2024): US$15.7

Target price (12m): US$21

Expected Share Price Return: 34%

Investment Risk: High

Rationale for investment

- Solar panel industry is experiencing a robust demand;

- Current low prices and market downturn will eventually result in a healthier market after excess capacity is resolved;

- Valuation is very undemanding at P/BV of 0.2x. Net cash on the books ($2.7bn as of 1Q24) is higher than its market cap ($1bn).

Profile

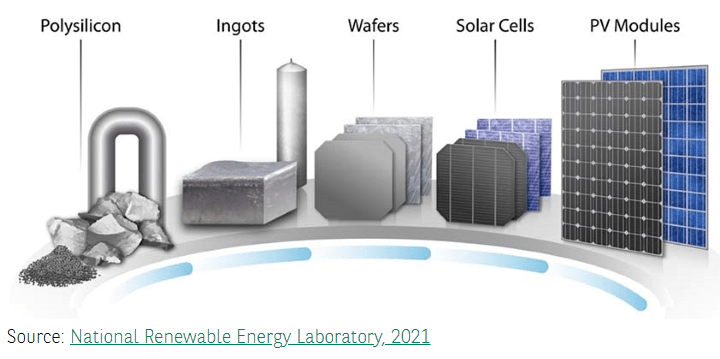

Daqo New Energy Corp. (NYSE: DQ) is a leading manufacturer of high-purity polysilicon for the global solar PV industry. The Company manufactures and sells high-purity polysilicon to photovoltaic product manufactures, who further process the polysilicon into ingots, wafers, cells and modules for solar power solutions. The Company has a total polysilicon nameplate capacity of 205,000 metric tons and is one of the world’s lowest cost producers of high-purity polysilicon.

To produce solar modules, polysilicon is melted at high temperatures to form ingots, which are then sliced into wafers and processed into solar cells and solar modules -see picture below.

Industry Overview

The solar panel industry has been undergoing a significant transformation, characterized by rapid expansion and technological advancements. Several factors are driving this growth:

Government Support: Strong government incentives, such as subsidies, tax credits, and favorable policies, are further boosting the adoption of solar energy. These measures are particularly prominent in China, the United States, and Europe, where renewable energy targets are driving significant investment in solar infrastructure.

Global Capacity Expansion: In 2023, newly installed global solar PV capacity surpassed 300 GW, setting a new record for the industry. China played a pivotal role in this growth, with its newly installed capacity reaching an unprecedented 217 GW, representing a 148% year-over-year increase. The momentum continued into the first quarter of 2024, with China’s solar PV installations totaling 45.7 GW, a 36% increase compared to the same period in 2023.

Cost Competitiveness: Solar energy has become one of the most competitive forms of power generation. Continuous reductions in the cost of solar PV products, coupled with decreasing solar energy generation costs, are expected to create substantial additional demand for solar installations worldwide.

Capacity and Pricing Issues

Despite the industry’s overall growth, the solar market is currently facing challenges related to overcapacity and pricing:

- Polysilicon Inventory: A major issue in the market has been the slow reduction of a large polysilicon inventory, estimated at around 300,000 metric tons in China. This oversupply has pressured prices and forced leading producers, including Tongwei, GCL, and Daqo, to cut production. According to market researcher InfoLink, Daqo and Xinte, another major producer, have reduced their utilization rates to approximately 50% and 30%, respectively, as of August 2024.

- Price Volatility: Polysilicon prices have been highly volatile in recent years, driven by fluctuating supply-demand dynamics, geopolitical tensions, and varying production costs. In the first half of 2024, market sentiment shifted sharply, with widespread expectations of price declines across the value chain, particularly for polysilicon. This led downstream manufacturers to lower utilization rates, reduce inventories, and delay orders, exacerbating the downward pressure on prices.

- Current Pricing Levels: As of April 2024, polysilicon prices for Tier-1 producers dropped to USD 5-6 per kilogram, which is close to the industry’s cash break-even cost. At these levels, many players in the solar value chain, including polysilicon producers, are facing unprofitability. This challenging environment is likely to persist until excess inventories are depleted, and the market undergoes necessary consolidation.

Market Outlook: While the short-term outlook remains challenging, I believe that the current low prices and market downturn will eventually lead to a healthier market structure. Poor profitability and cash burn will likely force weaker players out of the market, leading to capacity rationalization. As demand growth resumes, supported by favorable policies and the depletion of excess inventories, the solar PV industry should return to more sustainable profitability, with improved margins across the value chain

Prices

Current polysilicon spot price is US$5-6 per kg in China and US$@21 outside China. Prices outside China are generally higher due to several key factors:

Trade Policies and Tariffs: For instance, the U.S. has imposed tariffs on Chinese polysilicon imports due to concerns over forced labor practices in Xinjiang. These tariffs increase the cost of importing Chinese polysilicon, resulting in higher prices for non-Chinese polysilicon in markets outside China.

Higher Production Costs: Polysilicon production is highly energy-intensive, and energy costs are significantly higher outside China, particularly in regions like Europe and the United States. Chinese producers benefit from lower electricity costs, especially in areas with abundant and inexpensive coal-based power or hydropower, allowing them to produce polysilicon at a lower cost.

Economies of Scale: Chinese producers have made substantial investments in expanding their production capacity, achieving economies of scale that reduce the per-unit cost of polysilicon. This scale advantage enables Chinese companies to offer lower prices compared to their international counterparts, further widening the price gap.

Valuation

My 12-month price target of $21 is based on a 12-month target P/BV of 0.3x. Price/Book currently is 0.2x and P/E Ratio is 7x, below peers. Company holds more cash than debt on its balance sheet – $2.7bn in cash versus $1bn capitalization.

What is the trigger for a rerating of the stock ? Polysilicon prices should bottom out over next one year as the current price is unsustainable.

Investment Risks

- Overall, while the market appears to be stabilizing, polysilicon prices are likely to remain volatile in the near term, influenced by a complex mix of factors.

- The company has stated that its American depositary shares (ADSs) could be delisted from the New York Stock Exchange if the U.S. and China fail to reach an agreement on audit requirements;

- A free-cash-flow burn for the company is projected;

- DQ is going ahead with a massive expansion of capacity despite prices imploding.

I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see Disclaimer.

If you love the articles I write, follow my blog and never miss another investment opportunity !

2 thoughts on “Sunrise or Storm in a Volatile Solar Market (Daqo New Energy)”