This is a high risk strategy suitable for seasoned investors. It is posted only on my blog (no social media distribution). A long-short strategy leverage small-cap and large-cap dynamics. It can be a powerful tool for sophisticated investors. They aim to seek alpha while managing market risk. Investors can thoughtfully implement this approach to tap into the growth potential of small caps. At the same time, they can hedge some of the market risk by shorting large caps.

How the Strategy Works

Step 1: Long Small-Cap Stocks (Micro Russell 2000 Index Futures – Mar.25).

Buy 5 units Micro Russell 2000 Futures expiring Mar.2025 @ $2,263

Micro E-mini Russell 2000 futures (M2K) are smaller-sized futures contracts. They allow investors to gain exposure to the performance of the Russell 2000 index. This index tracks small-cap U.S. stocks. The Micro E-mini Russell 2000 futures contract is $5 x the Russell 2000 Index. It has a minimum tick of 0.10 index points.

Step 2: Short Large-Cap Stocks (Micro E-mini S&P 500 Futures – Mar. 25).

SELL 2 units Micro S&P Index Futures expiring Mar.2025 @ $6027

Micro E-mini S&P 500 futures (MES) are smaller-sized futures contracts. They are designed to offer traders a cost-effective way to manage exposure to the S&P 500 Index. The Micro E-mini S&P 500 futures contract is valued at $5 times the S&P 500 Index. It has a minimum tick of 0.25 index points.

Summary Trade

Long RTY Index : notional $56,575

Short S&P Index: notional -$60,270

Maturity: March 2025

Profit Target: +$5,000 (c.10% reduction in S&P Index over performance over Russell 2000 Index).

Stop Loss: -$2,500

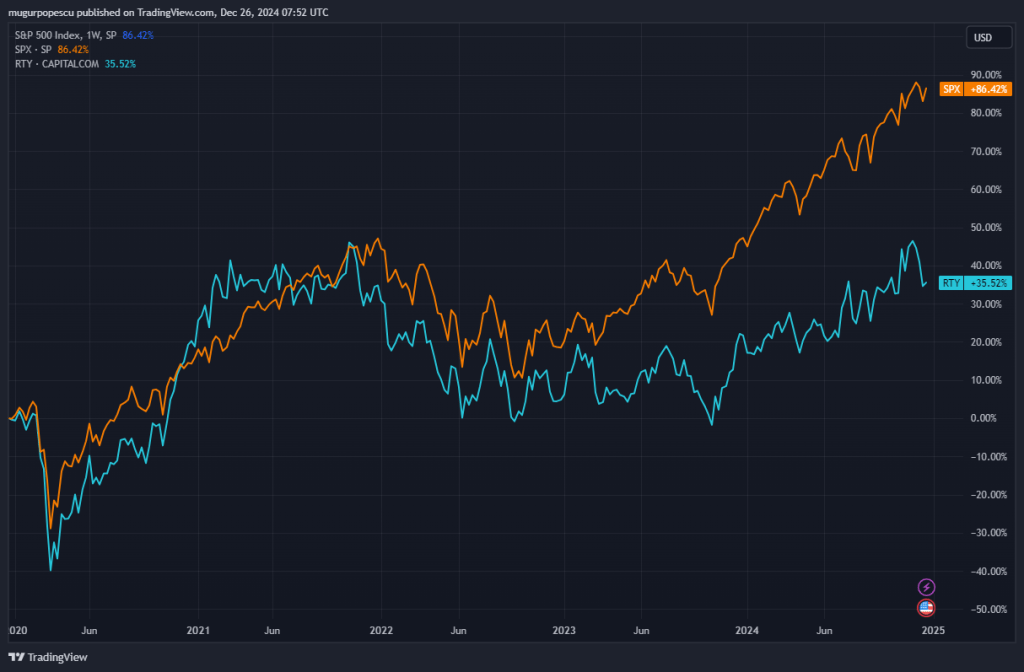

Historically, small-cap stocks have often outperformed their large-cap counterparts due to their greater growth potential and inefficiencies in pricing. Nevertheless, the situation has been dramatically different over the last decade. The S&P 500 Index has outperformed the Russell 2000 Index by about 52% over the last 5 years. It has outperformed even by over 100% over the last 10 years. I suspect this trend is about to reverse as the difference in financial performance does not justify it.

The price-to-earnings (P/E) ratio for the Russell 2000 Index is currently 27, while the P/E ratio for S&P 500 is 30.5.

See charts below (blue-Small Cap Index, orange-Large Cap Index):

Reasons for Large-Cap Out-performance Over Last Period

- Big tech companies like Nvidia and Microsoft led market gains through rapid revenue growth and their strong digital presence.

- Large caps, with stable models and strong balance sheets, attracted investors during global uncertainties like the pandemic.

- Their global reach and scale offered competitive advantages over smaller companies.

- Large-cap indices focus on high-growth sectors like tech, unlike small-cap indices with more cyclical exposure.

- Passive investing has funneled significant capital into large-cap indices, amplifying their gains.

The Rationale Behind Long – Short Strategy

See below my rationale for this trade idea:

- Historically, small cap returns have been similar compared to large-cap stocks;

- Smaller companies often have more room to grow and innovate compared to established large-cap firms;

- Small caps are less covered by analysts, creating more opportunities for mispricing;

- Pairing a long position in small caps with a short position in large caps. This strategy reduces exposure to overall market movements.

- This approach offers an option to traditional long-only equity strategies, providing diversification within an investment portfolio.

Risks

- Large caps may continue to outperform small caps. This can lead to losses on the both positions.

- Shorting, involves borrowing costs and margin requirements.

- Small-cap stocks are more sensitive to economic downturns and interest rate changes.

2 thoughts on “Leveraging Small-Cap Dynamics in a Long-Short Strategy”