Investment Performance in 2024

SINCE INCEPTION (JAN. 2019):

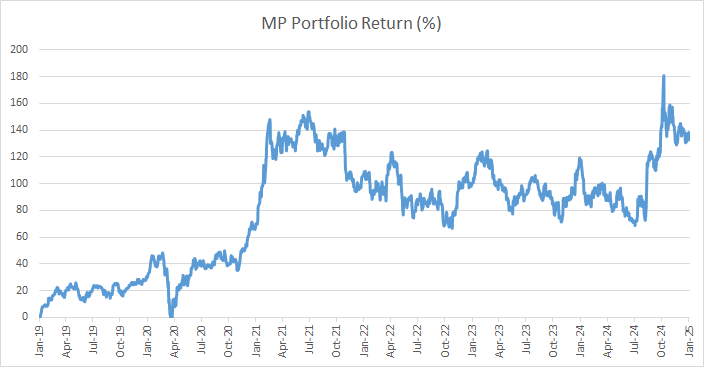

- Model Portfolio (MP): +138%

- Vanguard Total World Index (VT): +101%

- MP IRR*: +19%

FULL YEAR (2024):

- Model Portfolio (MP): +9%

- Vanguard Total World Index (VT): +16%

I hope you’ve all had a great 2024 !

Thank you for following my blog. It has been free, fun and educational and it was a profitable year for the ones that invested along.

Since inception, my portfolio appreciated by 138%.

The market did well overall last year, with the Vanguard Total Return Index gaining 16% and my portfolio returning 9%.

In 2024, global stock markets experienced significant growth, with major indices across various regions posting impressive returns. Here’s a summary of the performance:

- United States: The S&P 500 surged by 23%, setting a series of record highs.

- Europe: The Stoxx Europe 600 index achieved a 6.3% gain

- Asia: The MSCI China index rose by 21.6%

These gains were driven by several factors. Advancements in technology played a significant role, particularly in artificial intelligence. Additionally, a favorable economic background in major economies contributed to these gains.

Main reasons for my portfolio under-performance over global index are as follows. Office Property Income (OPI) stock lost 83% in 2024. I reduced the position, but was not sufficient as the drop was dramatic. Mag 7 stocks and Artificial Intelligence related stocks generated most of US and global index appreciation. None of these stocks are in my portfolio.

I also have had also strong performing names were:

Georgia Capital profit taken on half of position at GBP12.4/share returning +84% gain in 8 months. NYCB (a US regional bank renamed Flagstar Financial Inc) have lost nearly two-thirds of their value. This happened following a sell-off after the bank’s dismal Jan. 31 earnings report, a 70% cut to its dividend, and a ratings downgrade. I felt there is a good entry point without doing a detailed valuation. Proved to be correct (+37% in 4 months).

Portfolio Changes

I have published only three investment ideas. These are NYCB (bank), Daqo New Energy (renewable energy), and a Long/Short strategy on small cap stocks. I took profit on 3 positions: NYCB, Georgia Capital, and British American Tobacco (BATS / BTI). I also closed 2 positions in loss: Revance and Baioo.

Daqo New Energy appreciated 63% in 2 months exceeding my target price. Profit taken at $26/share and still have some in the portfolio;

Took some profit in Georgia Capital (+84% gain in 8 months).

Sold British American Tobacco (BATS / BTI) . The 9-10% dividend yield was not sufficient to achieve my return target over the past 5 years. Therefore, I exited the position with a total return of +13%.

Sold Revance Therapeutics. Crown company announced will acquire all of Revance’s outstanding shares at at 111% premium to Revance’s 60-day volume-weighted average price. Good deal.

Baioo was not investible anymore for EU investors due to its size, hence I liquidated the position with a loss.

Reduced exposure on Office Property Income Trust (real estate). Stock registered a large drop due to office real estate industry challenges.

Portfolio Overview

I currently have only 5 active names in the model portfolio and one name on the Watchlist. Portfolio is quite concentrated on renewables (solar). Largest exposure is SUNRUN (solar energy) with 27% of the portfolio. In terms of geographies, I cover companies in US, China and UK. All investments in this blog are companies from outside EU to avoid any potential conflicts of interest.

I also maintain a multi asset passive portfolio. It is composed of 4 asset classes: equity, bonds, commodities, and cash. This portfolio is replicated by ETF/ETC since Oct. 2021. The passive multi-asset portfolio performed in line with market, as it supposed to do, with 5% annualized return. Commodities was the best performing asset class until now +25%.

For more details see Model Portfolio page – Portfolio Updates.

The site registered more than 873 views. These views came from 538 visitors, mainly from Romania, US, Canada, Germany, and China. This was achieved without any marketing. The site is not aimed to achieve large number of clicks, but investment returns for the audience.

Investment Objective, Style and Tools

- In this blog I share investment ideas in order to have a more disciplined approach to my personal investments. I then consolidate personal investment ideas in a model portfolio so that anybody can benefit from it and be able to monitor performance;

- My objective is to make a return of min. 15% a year from a high conviction, low turnover and concentrated portfolio of less than 15 names;

- In general, I am looking for 20%+ return p. a. on each name including dividends, when initiating the position. I expect that some investments should not perform as expected;

- All costs for site design, hosting and development are supported by myself.

Decision Making Process and Risk Management

I write a blog post for each investment case every time I initiate a position. Then I provide updates when I add or sell positions. I also update the target price with comments. This is a highly concentrated, long only (no shorts) portfolio of equity names. I do not use stop loss for protection. This investment strategy has a high risk – equity and concentration risk. Past performance does not necessarily equate to future results. Please read the disclaimer.

Plans for 2026

- Target annual return of min. 15% a year from a concentrated portfolio of less than 15 equity names;

- Internal Rate of Return (IRR) of at least 20%;

- Focus on non EU stocks (mainly US and China);

- Publish at least one new investment idea per semester.

Please do not forget to subscribe with your e-mail to not miss any opportunity!

All figures in USD. IRR was calculated with an amount of c. $1k invested in each name; trading fees of $2/trade included. Returns from dividends amounting to approx. 5% portfolio cost yield are included.