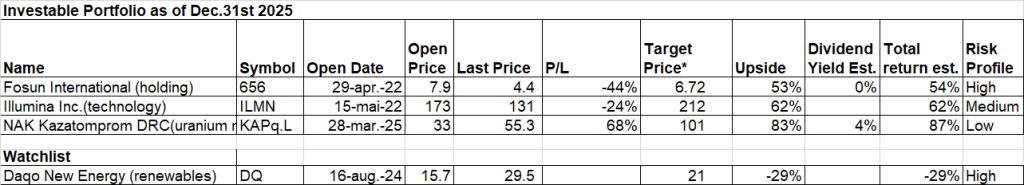

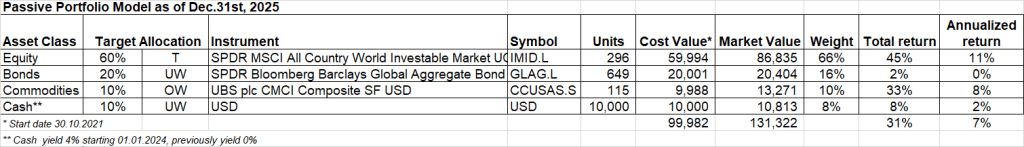

Please see below latest model portfolio. Consult the blog archive for details on each name and the disclaimer:

Live Model Portfolio Sharing

Link Current Positions

Link Portfolio Report

Latest Portfolio Updates (reverse chronological order):

- Upgraded KAZATOMPROM target price at USD101/share. The current price of Uranium futures at USD78 is 2.7x versus the time of my first analysis. The global uranium market is expected to reach $13.59 billion by 2032, with an annual growth rate of 4.9 percent during the 2025-2032 -Dec.2025.

- Closed the long-short strategy at a loss. I kept only a small short for S&P Index – Oct.2025

- DQ profit taken at USD24/share (+53% profit). Still keep it on my watchlist. – July 2025

- Closed SUNRUN at $9.8/share. Policy risk is existential—loss of tax credits would decrease installations by up to 40%. RUN’s debt (5.2x equity), negative free cash flow and fierce competition – June 2025

- Reopened KAZATOMPROM position at USD33/share – Mar.2025

- Reviewed downward target prices for SUNRUN and ILLUMINA – Mar.2025;

- PAX GLOBAL profit taken at HKD5.3/share (+76% profit taken). Upside looks limited despite 10% dividend yield- Feb.2025

- ILLUMINA double down the exposure at USD111/share- Feb.2025

- Building the Future Electric Grid (SUNRUN) double down the exposure at USD8.5/share- Jan.2025

- Georgia Capital profit taken at GBP12/share (+77% gain). CEO is at risk of US sanctions- Jan. 2025;

- Office Property Income Trust. Exposure liquidated at USD1/share-Jan. 2025;

- Please see Blog Archive for history

Make a one-time donation

Choose an amount

€5.00

€15.00

€50.00

Your contribution is appreciated. This site was originally built to help manage my own portfolio. I then decided to share it freely when I realized it might be useful to many other investors. In order to be able to continue to add new features I welcome any donation from users to help share the burden of running this site.

Donate