Investment Performance in 2023

FULL YEAR (2023):

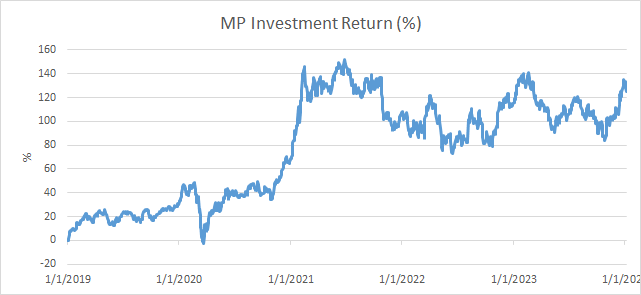

- Model Portfolio (MP): +9%

- Vanguard Total World Index (VT): +22%

SINCE INCEPTION (JAN. 2019):

- Model Portfolio (MP): +125%

- Vanguard Total World Index (VT): +70%

- MP IRR*: +22.5%

I hope you’ve all had a great end to 2023!

Thank you for following my blog. It has been free, fun and educational and it was a profitable year for the ones that invested along.

The site registered more than 1185 views from 538 visitors mainly from Romania, China, US and UK. The site is not aimed to achieve large number of clicks, but investment returns for the audience.

Since inception, my portfolio appreciated by 125%. The market did well overall last year, with the Vanguard Total Return Index gaining 22% and my portfolio returning 9%. China stocks ended 2023, with losses exceeding 10%, which is the main reason why my return was lower than the index. Best performing name was Georgia Capital with 50%+ appreciation. Around half of my investments in the portfolio pay a sustainable dividend (c. 5% average portfolio yield).

Portfolio Changes

I have published a new company (investment idea), reopened 2 positions that were closed in profit in the past but became attractive again, and took profit in 2 positions.

Office Property Income Trust (real estate) position opened in Apr. and doubled down in May 2023. The stock registered a large drop due to a dividend cut, a merger story and office real estate industry challenges. Lessons learnt: do not double down exposure too early or better do not throw away new money after bad money at all. Sustainable dividend yield is at 15%, hence and I see upside from here.

Revance Therapeutics(biotech) reopened the position at $7.3. When next-generation Botox similar was approved by FDA, I took profit at USD30.5/share (+95%) in oct. 2022.

Kazatomprom (mining) reopened in May and took profit at $42 representing 62% return in Oct. 2023;

I liquidated Zhongzhi Pharma for profit taking (+60%) and BHC at a smaller profit.

Portfolio Overview

I currently have 9 active names in the model portfolio and 4 names on the Watchlist. Portfolio contains a variety of investing themes from real estate to biotechnology. Largest exposure currently is OPI (real estate) with 20% of the portfolio. In terms of geographies, I coved companies in US, China and UK. All investments in this blog are companies from outside EU to avoid any potential conflicts of interest.

I also maintain a multi asset passive portfolio composed of 4 asset classes (equity, bonds, commodities and cash) replicated by ETF/ETC since Oct. 2021. The passive multi-asset portfolio performed in line with market as it supposed to do. Commodities was the only asset class with positive performance over the period.

For more details see Model Portfolio page – Portfolio Updates.

Investment Objective, Style and Tools

- In this blog I share investment ideas in order to have a more disciplined approach to my personal investments. I then consolidate personal investment ideas in a model portfolio so that anybody can benefit from it and be able to monitor performance;

- My objective is to make a return of min. 15% a year from a high conviction, low turnover and concentrated portfolio of less than 15 names;

- In general, I am looking for 20%+ return p. a. on each name including dividends, when initiating the position. I expect that some investments should not perform as expected;

- All costs for site design, hosting and development are supported by myself.

Decision Making Process and Risk Management

I write a blog post for each investment case every time I initiate a position and then I provide updates add/sell positions or target price with comments. This is a highly concentrated, long only (no shorts) portfolio of equity names. I do not use stop loss for protection. I do not employ leverage. This investment strategy has a high risk – equity and concentration risk. Past performance does not necessarily equate to future results. Please read the disclaimer.

Plans for 2024

- Target annual return of min. 15% a year from a concentrated portfolio of less than 15 equity names;

- Internal Rate of Return (IRR) of at least 25%;

- Focus on non EU stocks (mainly US and China);

- Publish at least one new investment idea per semester.

Please do not forget to subscribe with your e-mail to not miss any opportunity!

All figures in USD. IRR was calculated with an amount of c. $1k invested in each name; trading fees of $2/trade included. Returns from dividends amounting to approx. 5% portfolio cost yield are included.